Think of your average day: how do you get to school? Are you driving? How are you filling up on gas? What are you wearing? What do you eat for lunch? What do you do after school? How late are you working? What video game are you playing?

On a daily basis, teenagers spend money on food, clothing, technology, and gas. In fact, in 2024 teenagers spent an average of over $2,300, according to a study by investment bank firm, Piper Sandler.

Most teenagers have a part-time job, or an allowance from their parents, which means they have a source of income funding their numerous expenses. However, according to a study by Fidelity Investments, only 23% of teenagers are currently investing in the stock market, despite almost three quarters of teens believing investing is important.

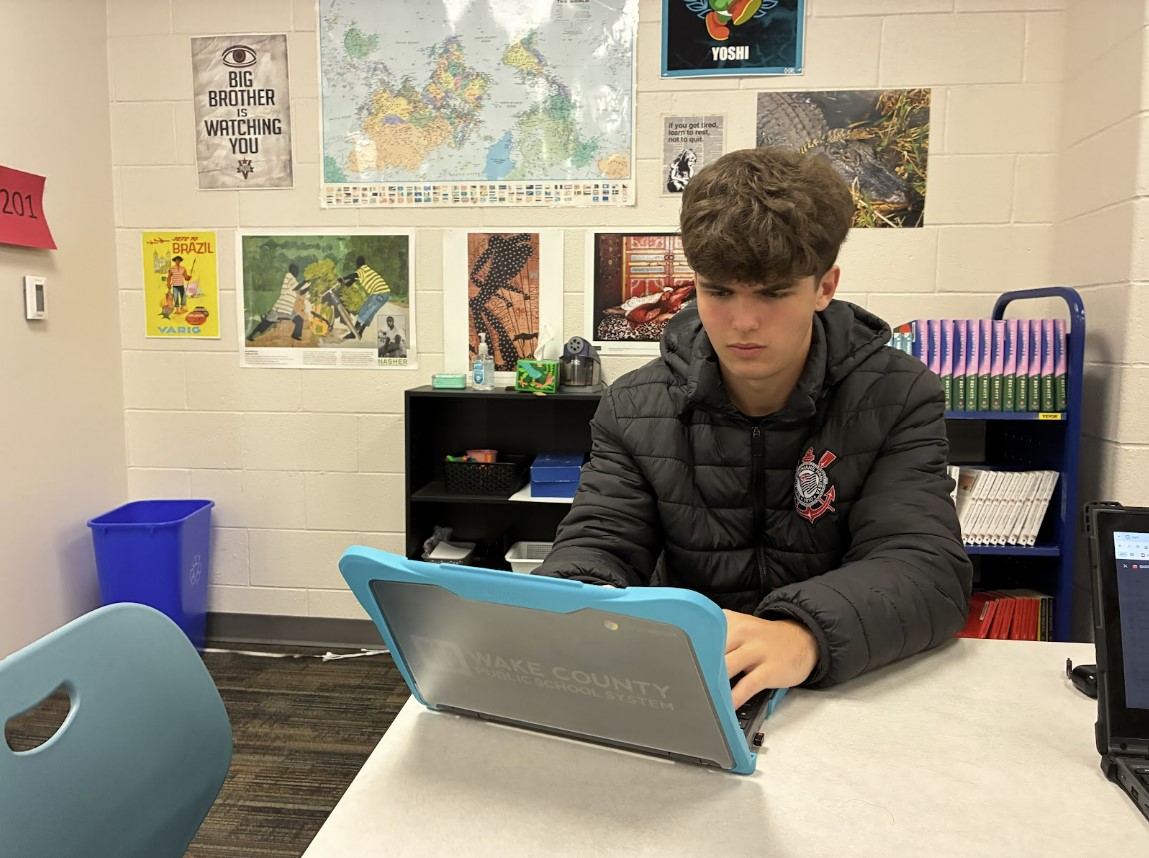

Senior Alex Staponkus, an example of a teen investor in the stock market, believes that teens have a variety of benefits from becoming an investor at an early age.

“Why not?” Staponkus said, “The earlier you start, the more money you can make on a timeline because of compound interest. You are able to get a head start over other people.”

By starting at an early age, teenagers can learn many strategies on how to manage their stock market portfolios, and teens can also learn many qualities that can be beneficial to their future, when they have a career, and are employed.

“It builds a lot of discipline,” Staponkus said, “if you start young, you’ll learn to separate your paychecks now, and you’ll be able to separate your paychecks when your income is much higher.”

For teens who are looking to start investing, the steps are simple. Teens under eighteen can start by having their parents open an investment account, in which the account can transfer to the teen when they turn eighteen.

Another option for teens is a joint-brokerage account. A joint account is shared by the teen and their parent, and teens can make decisions on how to invest in the stock market with approval of the parent, or account-owner.

“Just be consistent, and disciplined,” Staponkus said. “Just set aside some money every time you get paid, or every birthday, that’s what I did.”

Staponkus is just one example of many teens that are interested in the stock market, but, with teen spending on the rise, and more ways to start investing, teens have a variety of reasons to become an investor in the stock market.